Dayforce Reports Third Quarter 2025 Results

- Dayforce® recurring revenue, excluding float, of $333 million, up 14% on a GAAP and constant currency basis

- Total revenue of $482 million, up 10%, and excluding float, up 11%, or 12% on a constant currency basis

- Year-to-date net cash provided by operating activities of $194 million

Dayforce, Inc. ("Dayforce" or the "Company") (NYSE:DAY) (TSX:DAY), a global leader in human capital management ("HCM") technology, today announced its financial results for the third quarter ended September 30, 2025.

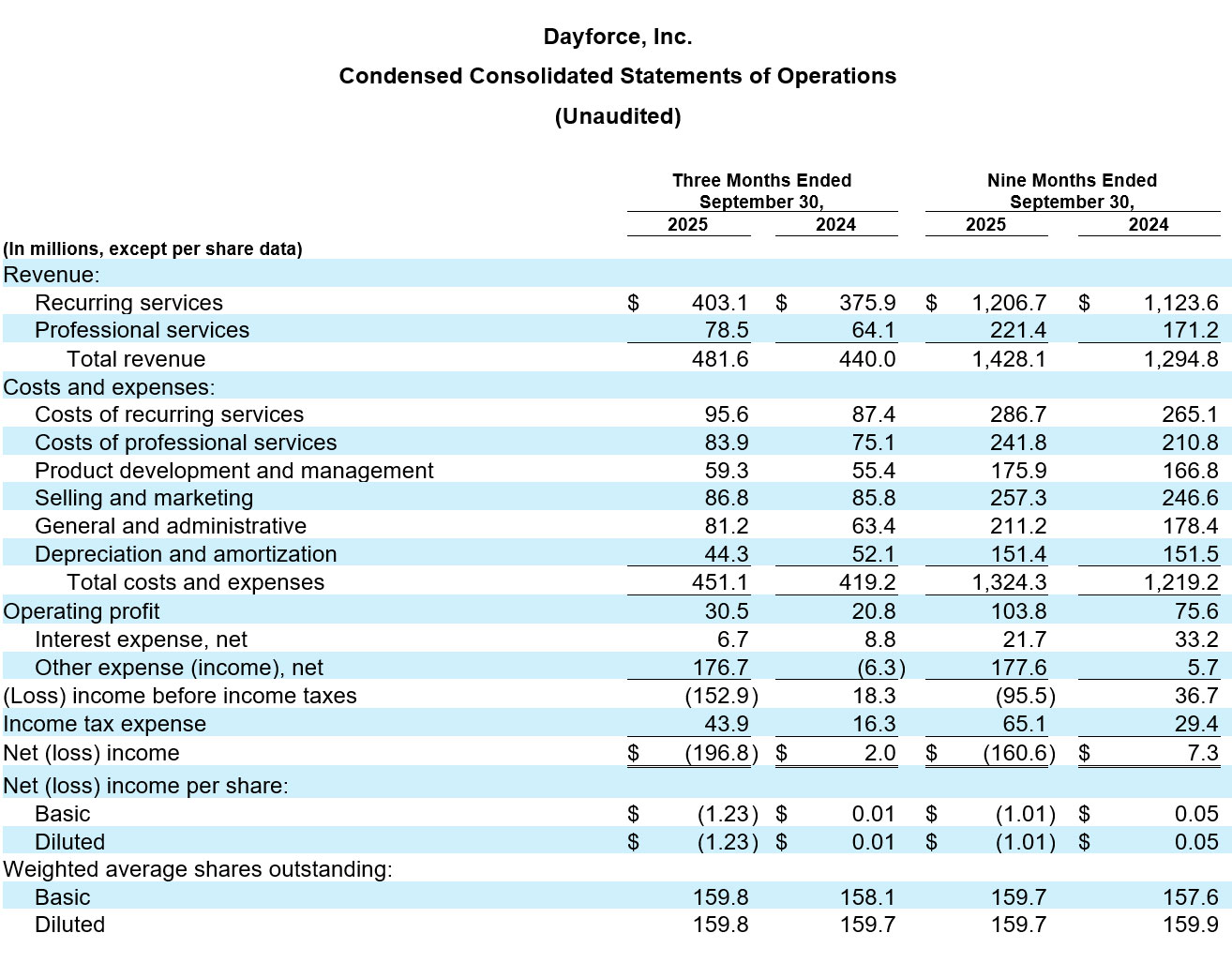

Financial Highlights for the Third Quarter 20251

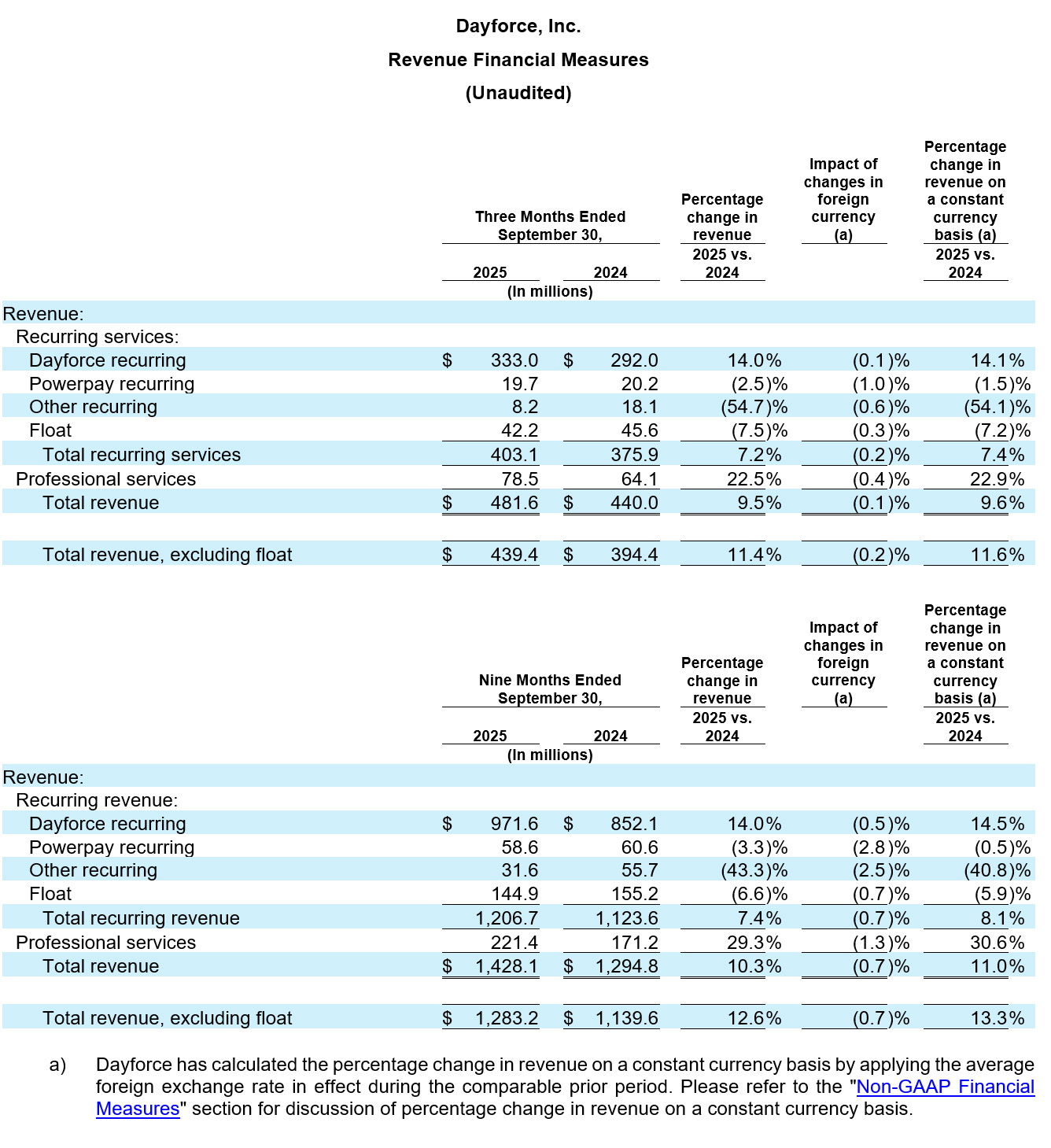

- Total revenue was $481.6 million, an increase of 9.5%, or 9.6% on a constant currency basis. Excluding float, total revenue was $439.4 million, an increase of 11.4%, or 11.6% on a constant currency basis.

- Dayforce recurring revenue, excluding float, was $333.0 million, an increase of 14.0%, or 14.1% on a constant currency basis.

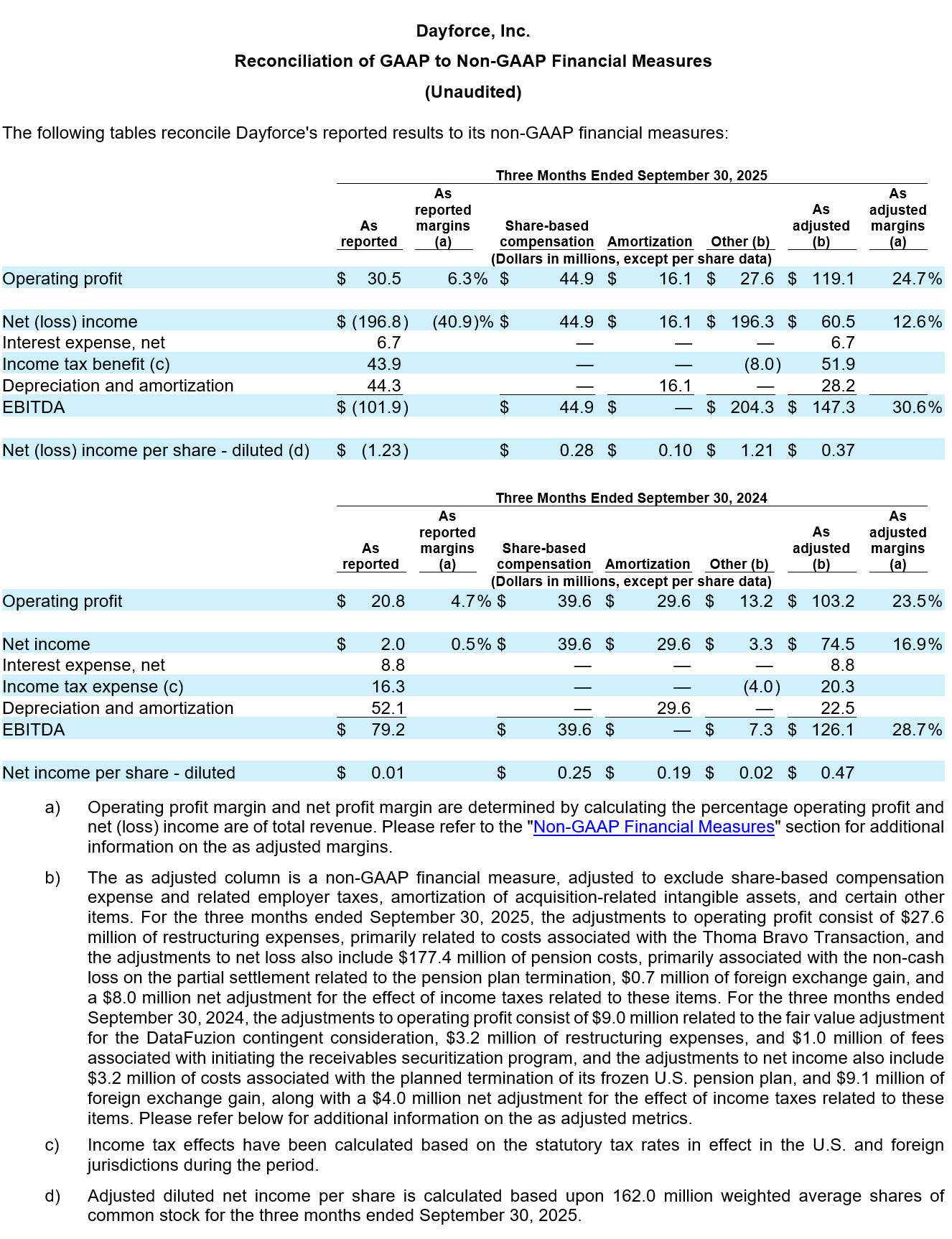

- Operating profit was $30.5 million, compared to $20.8 million. Adjusted operating profit was $119.1 million, compared to $103.2 million.

- Net loss was $196.8 million, compared to net income of $2.0 million and net profit margin was (40.9)%, compared to 0.5%. Adjusted net income was $60.5 million, compared to $74.5 million.

- Adjusted EBITDA was $147.3 million, compared to $126.1 million. Adjusted EBITDA margin was 30.6%, compared to 28.7%.

- Diluted net loss per share was $1.23, compared to diluted net income per share of $0.01. Adjusted diluted net income per share was $0.37, compared to $0.47.

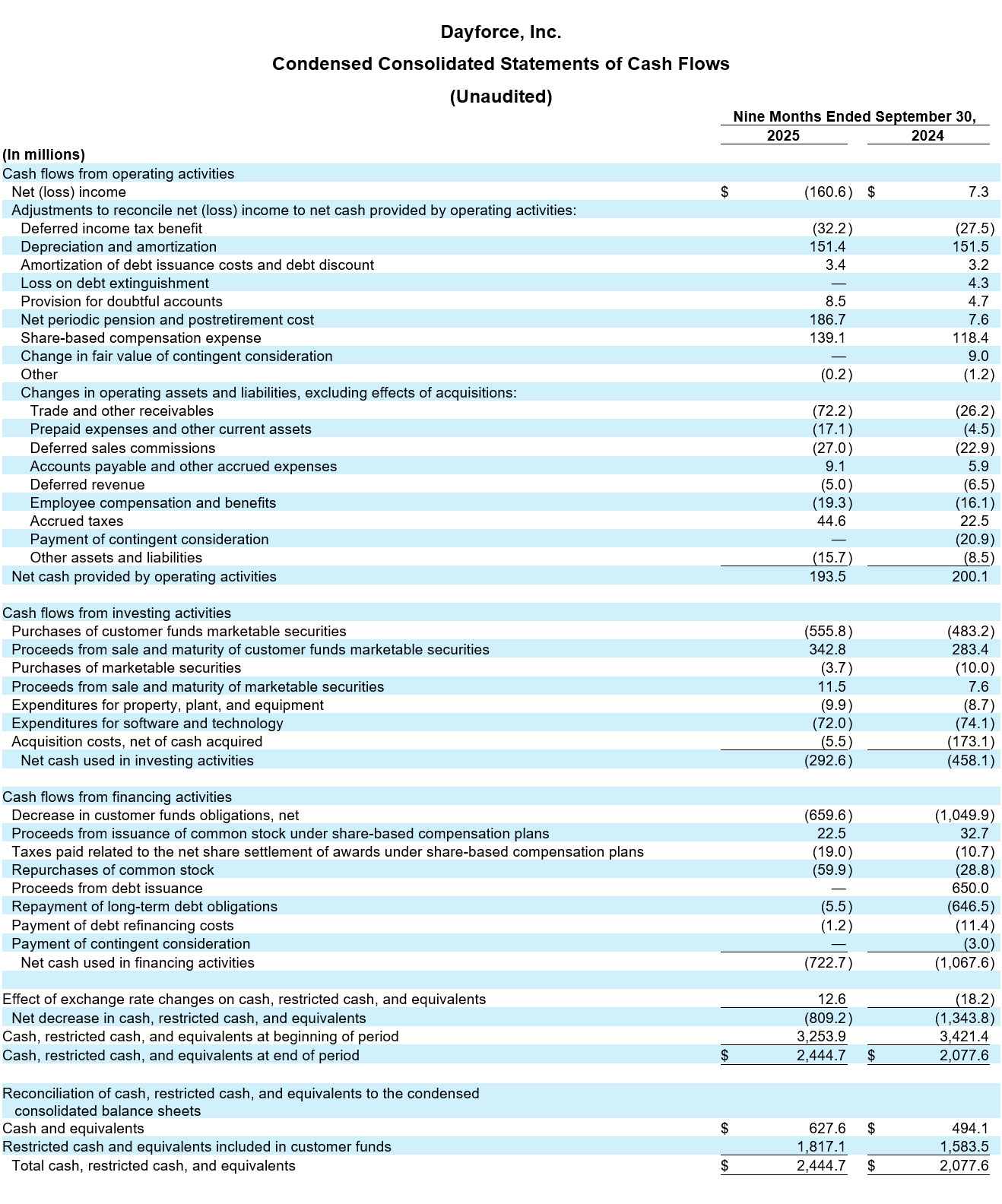

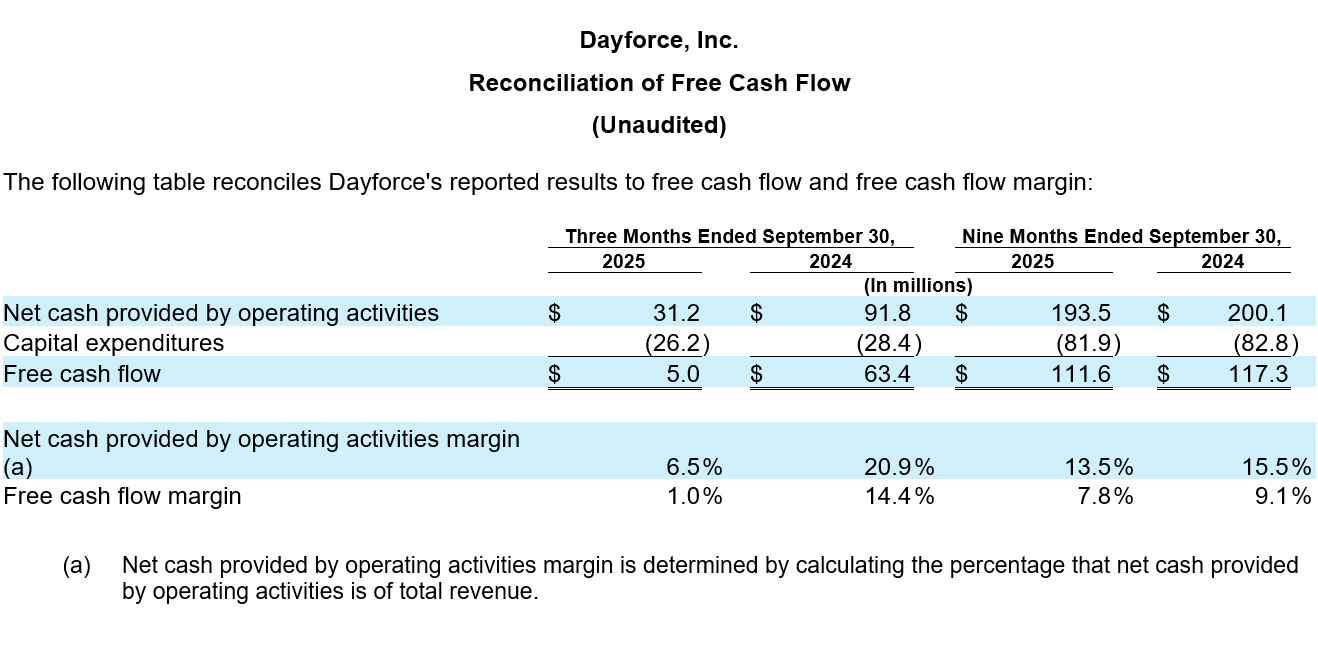

- Net cash provided by operating activities for the nine months ended September 30, 2025 was $193.5 million, compared to $200.1 million for the nine months ended September 30, 2024. Net cash provided by operating activities margin for the nine months ended September 30, 2025 was 13.5%, compared to 15.5% for the nine months ended September 30, 2024.

- Free cash flow for the nine months ended September 30, 2025 was $111.6 million, compared to $117.3 million for the nine months ended September 30, 2024. Free cash flow margin for the nine months ended September 30, 2025 was 7.8%, compared to 9.1% for the nine months ended September 30, 2024.

Supplemental Detail

- 7,025 customers were live on the Dayforce platform as of September 30, 2025, an increase of 4.4% year-over-year.2

- Dayforce recurring revenue per customer was $175,172 for the trailing twelve months ended September 30, 2025, an increase of 9.8%.3

- The average float balance for Dayforce's customer funds during the quarter was $4.54 billion and the average yield on Dayforce's float balance was 3.7%. Float revenue from invested customer funds was $42.2 million for the three months ended September 30, 2025.

1 The financial highlights are on a year-over-year basis, unless otherwise stated. All financial results are reported in United States ("U.S.") dollars and in accordance with accounting principles generally accepted in the U.S. ("GAAP"), unless otherwise stated.

2 Excluding Ascender, ADAM HCM, and eloomi.

3 Excluding float revenue, Ascender, ADAM HCM, and eloomi revenue, and on a constant currency basis. Please refer to the “Non-GAAP Financial Measures” section for discussion of percentage change in revenue on a constant currency basis.

Thoma Bravo Transaction

As previously announced, on August 20, 2025, Dayforce entered into an Agreement and Plan of Merger (the "Merger Agreement") under which certain affiliates of Thoma Bravo, L.P. ("Thoma Bravo") will acquire Dayforce for $70.00 in cash per share of Dayforce common stock for a total enterprise value of approximately $12.3 billion, and Dayforce will become a privately-held company. Dayforce expects to complete the transaction, which is referred to herein as the "Thoma Bravo Transaction", in late 2025 or early 2026, subject to fulfillment of customary closing conditions, including approval of Dayforce stockholders and receipt of required regulatory approvals.

Recent Developments

- Dayforce sales strong momentum continued through the third quarter.

- Dayforce saw declining employment levels at our customers in the third quarter negatively impacting Dayforce recurring revenue, excluding float.

- Restructuring expenses of $27.6 million, primarily related to costs associated with the Thoma Bravo Transaction, negatively impacted free cash flow in the third quarter.

- Dayforce was named a Leader in the 2025 Gartner Magic Quadrant for Cloud HCM Suites for 1,000+ Employee Enterprises for the sixth consecutive year in September 2025. The Company also scored highest in three out of six use cases studied by the companion Gartner Critical Capabilities report, more than any other vendor.

- The Company achieved record attendance at Dayforce Discover 2025, its annual customer conference in Las Vegas, where it welcomed its global community of customers, prospective customers, partners, and industry disruptors.

Business Outlook and Earnings Conference Call

In light of the pending Thoma Bravo Transaction, Dayforce will not be providing forward-looking guidance or updates to previously issued guidance and will not host an earnings conference call or webcast for its third quarter fiscal 2025 results and does not expect to do so for any future quarters. Earnings materials are publicly available on the Investor Relations page of Dayforce’s website at investors.dayforce.com.

About Dayforce

Dayforce makes work life better. Everything we do as a global leader in HCM technology is focused on enabling thousands of customers and millions of employees around the world do the work they're meant to do. With our single AI-powered people platform for HR, Pay, Time, Talent, and Analytics, organizations of all sizes and industries are benefiting from simplicity at scale with Dayforce to help unlock their full workforce potential, operate with confidence, and realize quantifiable value. To learn more, visit dayforce.com.

Forward-Looking Statements

This press release contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact or relating to present facts or current conditions included in this press release are forward-looking statements. Forward-looking statements give Dayforce's current expectations and projections relating to its financial condition, results of operations, plans, objectives, future performance, and business. Users can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements in this press release include statements relating to the Thoma Bravo Transaction. These statements may include words such as “anticipate,” “estimate,” “expect,” "assume", “project,” “seek,” “plan,” “intend,” “believe,” “will,” “may,” “could,” “continue,” “likely,” “should,” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events, but not all forward-looking statements contain these identifying words. The forward-looking statements contained in this press release are based on assumptions that Dayforce has made in light of its industry experience and its perceptions of historical trends, current conditions, expected future developments and other factors that it believes are appropriate under the circumstances. As users consider this press release, it should be understood that these statements are not guarantees of performance or results. These assumptions and Dayforce’s future performance or results involve risks and uncertainties (many of which are beyond its control). In particular:

- the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the Thoma Bravo Transaction that could delay the consummation of the Thoma Bravo Transaction or cause the parties to abandon the Thoma Bravo Transaction;

- the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement entered into in connection with the Thoma Bravo Transaction;

- the possibility that our stockholders may not approve the Thoma Bravo Transaction;

- the risk that the parties to the Merger Agreement may not be able to satisfy the conditions to the Thoma Bravo Transaction in a timely manner or at all;

- risks related to disruption of management time from ongoing business operations due to the Thoma Bravo Transaction;

- the risk that any announcements relating to the Thoma Bravo Transaction could have adverse effects on the market price of our common stock;

- the risk of any unexpected costs or expenses resulting from the Thoma Bravo Transaction;

- the risk of any litigation relating to the Thoma Bravo Transaction;

- the risk that the Thoma Bravo Transaction and its announcement could have an adverse effect on our ability to retain and hire key personnel and to maintain relationships with customers, vendors, partners, employees, stockholders and other business relationships and on our operating results and business generally;

- our ability to continue to sustain and grow revenue from our recurring services solutions;

- any information security breach of our systems or the loss of, or unauthorized access to, customer information or sensitive company information;

- disruptions to the movement of funds to initiate payroll-related transactions on behalf of our customers, or customer inability to provide funds sufficient to cover the amounts paid on their behalf, or funds advanced to them via our Dayforce Wallet product;

- our aging software infrastructure and technology;

- our ability to manage our growth effectively;

- our ability to compete effectively in the competitive markets in which we participate;

- our exposure to risks inherent to our international sales and operations;

- any failure to manage our technical operations infrastructure, or the impact of service outages or delays in the implementation of our applications, or the failure of our applications to perform properly;

- our reliance on strategic relationships with third parties to drive additional growth;

- any failure to offer high-quality support services;

- any dissatisfaction of our customers with the quality and pace of the implementation and professional services provided by us or our partners;

- any loss of key employees or the inability to attract and retain highly skilled employees;

- any loss of customer funds and wage funds of their employees that our trustees and third-party financial institution partners hold;

- our acquisition of other companies or technologies;

- the implementation of new accounting systems or other applications;

- any failure to protect our intellectual property rights or any lawsuits against us for alleged infringement of third-party proprietary rights;

- the use of open source software in our applications;

- our failure, or the failure of our third-party service providers, to comply with laws and regulations, or to update our solutions to reflect changes in applicable laws and regulations;

- additional regulatory requirements placed on our software and services;

- any litigation and regulatory investigations aimed at us;

- any actual or perceived failure to comply with evolving regulatory frameworks around the development and use of Artificial Intelligence;

- our existing and future debt obligations;

- volatility in the price of our common stock or the issuance of additional common stock;

- our share repurchase program;

- any change in our intention to not pay cash dividends in the foreseeable future;

- provisions in our certificate of incorporation and bylaws and Delaware law that might discourage, delay or prevent a change of control of the Company or changes in our management;

- any failure to maintain effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act;

- adverse economic and market conditions, including, among other things, the potential effects of recessionary environments on customer employment levels, changes in interest rates affecting float revenue, uncertainties related to the adoption and impact of Artificial Intelligence, and our ability to sustain growth in a highly competitive industry;

- fluctuations in our quarterly results;

- catastrophic events and our disclosures and ambitions related to sustainability matters;

- our being subject to taxation in multiple jurisdictions; and

- any changes in generally accepted accounting principles in the United States.

Although Dayforce has attempted to identify important risk factors, additional factors or events that could cause Dayforce’s actual performance to differ from these forward-looking statements may emerge from time to time, and it is not possible for Dayforce to predict all of them. Should one or more of these risks or uncertainties materialize, or should any of Dayforce’s assumptions prove incorrect, its actual financial condition, results of operations, future performance, and business may vary in material respects from the performance projected in these forward-looking statements. In addition to any factors and assumptions set forth above in this press release, the material factors and assumptions used to develop the forward-looking information include, but are not limited to: the general economy remains stable; the competitive environment in the HCM market remains stable; the demand environment for HCM solutions remains stable; Dayforce’s implementation capabilities and cycle times remain stable; foreign exchange rates, both current and those used in developing forward-looking statements, specifically U.S. dollar to Canadian dollar, remain stable at, or near, current rates; Dayforce will be able to maintain its relationships with its employees, customers, and partners; Dayforce will continue to attract qualified personnel to support its development requirements and the support of its new and existing customers; and that the risk factors noted above, individually or collectively, do not have a material impact on Dayforce. Any forward-looking statement made by Dayforce in this press release speaks only as of the date on which it is made. Dayforce undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Non-GAAP Financial Measures

Dayforce uses certain non-GAAP financial measures in this release including:

| Non-GAAP Financial Measure | GAAP Financial Measure |

| EBITDA | Net (loss) income |

| Adjusted EBITDA | Net (loss) income |

| Adjusted EBITDA margin | Net profit margin |

| Adjusted operating profit | Operating profit |

| Adjusted operating profit margin | Operating profit margin |

| Adjusted net income | Net (loss) income |

| Adjusted net profit margin | Net profit margin |

| Adjusted diluted net income per share | Diluted net (loss) income per share |

| Free cash flow | Net cash provided by operating activities |

| Free cash flow margin | Net cash provided by operating activities margin |

| Percentage change in revenue, including total revenue and revenue by solution, on a constant currency basis | Percentage change in revenue, including total revenue and revenue by solution |

| Dayforce recurring revenue per customer | No directly comparable GAAP measure |

Dayforce believes that these non-GAAP financial measures are useful to management and investors as supplemental measures to evaluate its overall operating performance including comparison across periods and with competitors. Dayforce's management team uses these non-GAAP financial measures to assess operating performance because these financial measures exclude the results of decisions that are outside the normal course of its business operations, and are used for internal budgeting and forecasting purposes both for short- and long-term operating plans. Additionally, Adjusted operating profit, free cash flow, and free cash flow margin are components of certain management compensation plans. Additionally, Dayforce believes that the non-GAAP financial measures free cash flow and free cash flow margin are meaningful to investors because they are measures of liquidity that provides useful information in understanding and evaluating the strength of Dayforce’s liquidity and future ability to generate cash that can be used for strategic opportunities or investing in its business. The reduction of capital expenditures facilitates comparisons of Dayforce’s liquidity on a period-to-period basis and excludes items that management does not consider to be indicative of Dayforce’s liquidity.

These non-GAAP financial measures are not required by, defined under, or presented in accordance with, GAAP, and should not be considered as alternatives to Dayforce's results as reported under GAAP, have important limitations as analytical tools, and its use of these terms may not be comparable to similarly titled measures of other companies in its industry. Dayforce's presentation of non-GAAP financial measures should not be construed to imply that its future results will be unaffected by similar items to those eliminated in this presentation. Please refer to Dayforce’s full financial results, including further discussion of non-GAAP financial measures, on the Investor Relations portion of its website at investors.dayforce.com.

Dayforce defines its non-GAAP financial measures as follows:

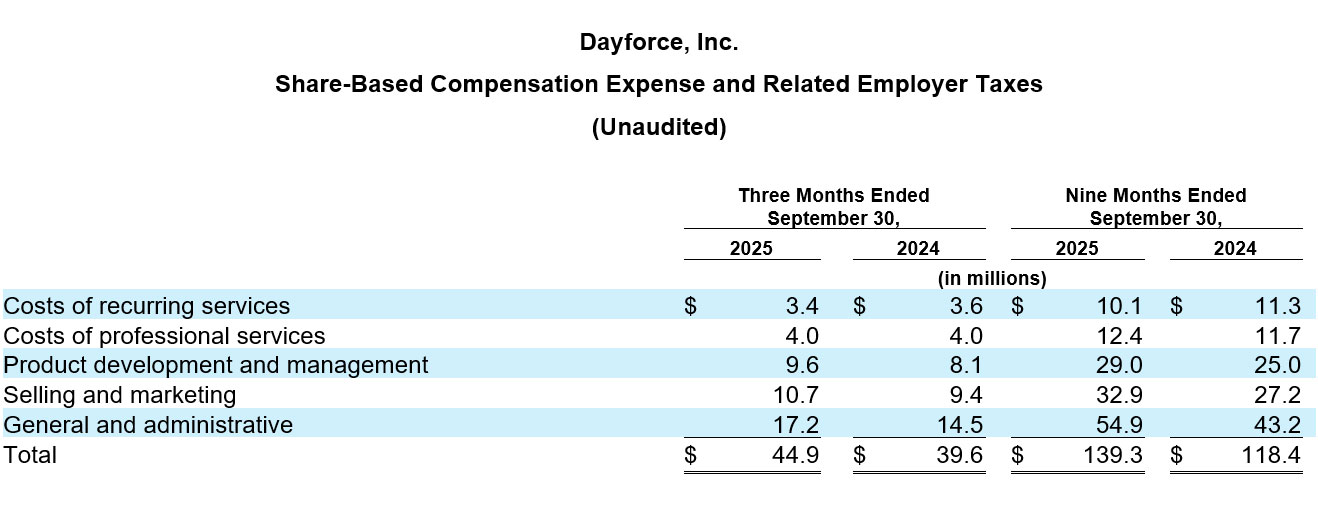

- EBITDA is defined as net (loss) income before interest, taxes, depreciation, and amortization, and Adjusted EBITDA is EBITDA, as adjusted to exclude share-based compensation expense and related employer taxes, and certain other items.

- Adjusted EBITDA margin is determined by calculating the percentage Adjusted EBITDA is of total revenue.

- Adjusted operating profit is defined as operating profit, as adjusted to exclude share-based compensation expense and related employer taxes, amortization of acquisition-related intangible assets, and certain other items.

- Adjusted operating profit margin is determined by calculating the percentage Adjusted operating profit is of total revenue.

- Adjusted net income is defined as net (loss) income, as adjusted to exclude share-based compensation expense and related employer taxes, amortization of acquisition-related intangible assets, and certain other items, all of which are adjusted for the effect of income taxes.

- Adjusted net profit margin is determined by calculating the percentage Adjusted net income is of total revenue.

- Adjusted diluted net income per share is calculated by dividing adjusted net income by diluted weighted average shares outstanding. When adjusted net income is positive, diluted weighted average shares outstanding incorporate the effect of dilutive equity instruments.

- Free cash flow is defined as net cash provided by operating activities, reduced by capital expenditures.

- Free cash flow margin is determined by calculating the percentage that free cash flow is of total revenue.

- Percentage change in revenue, including total revenue and revenue by solution, on a constant currency basis is calculated by applying the average foreign exchange rate in effect during the comparable prior period.

- Dayforce recurring revenue per customer is an indicator of the average size of Dayforce recurring revenue customers. To calculate Dayforce recurring revenue per customer, we start with Dayforce recurring revenue on a constant currency basis by applying the same exchange rate to all comparable periods for the trailing twelve months and excludes float revenue, and Ascender, ADAM HCM, and eloomi revenue. This amount is divided by the number of live Dayforce customers at the end of the trailing twelve month period, excluding Ascender, ADAM HCM, and eloomi. We have not reconciled Dayforce recurring revenue per customer to a GAAP financial measure because there is no directly comparable GAAP financial measure.

Source: Dayforce, Inc.

For further information, please contact:

Investor Relations

1-844-829-9499

investors@dayforce.com

Public Relations

1-647-417-2117

teri.murphy@dayforce.com