Dayforce Wallet

Provide flexible, on-demand pay with Dayforce Wallet

Embrace the power of on-demand pay for a happier workforce.

On-Demand Pay

Pay your people at the pace of real life

Don’t let your employees’ financial stress lead to a disengaged and absent workforce. Providing your people with access to their earned wages on demand gives them complete control over their finances, helps your organisation attract talent, and gives employees a reason to stay with you in the long run.

Give your people a reason to choose you

Offer a financial wellness benefit to help you stand out from the competition.

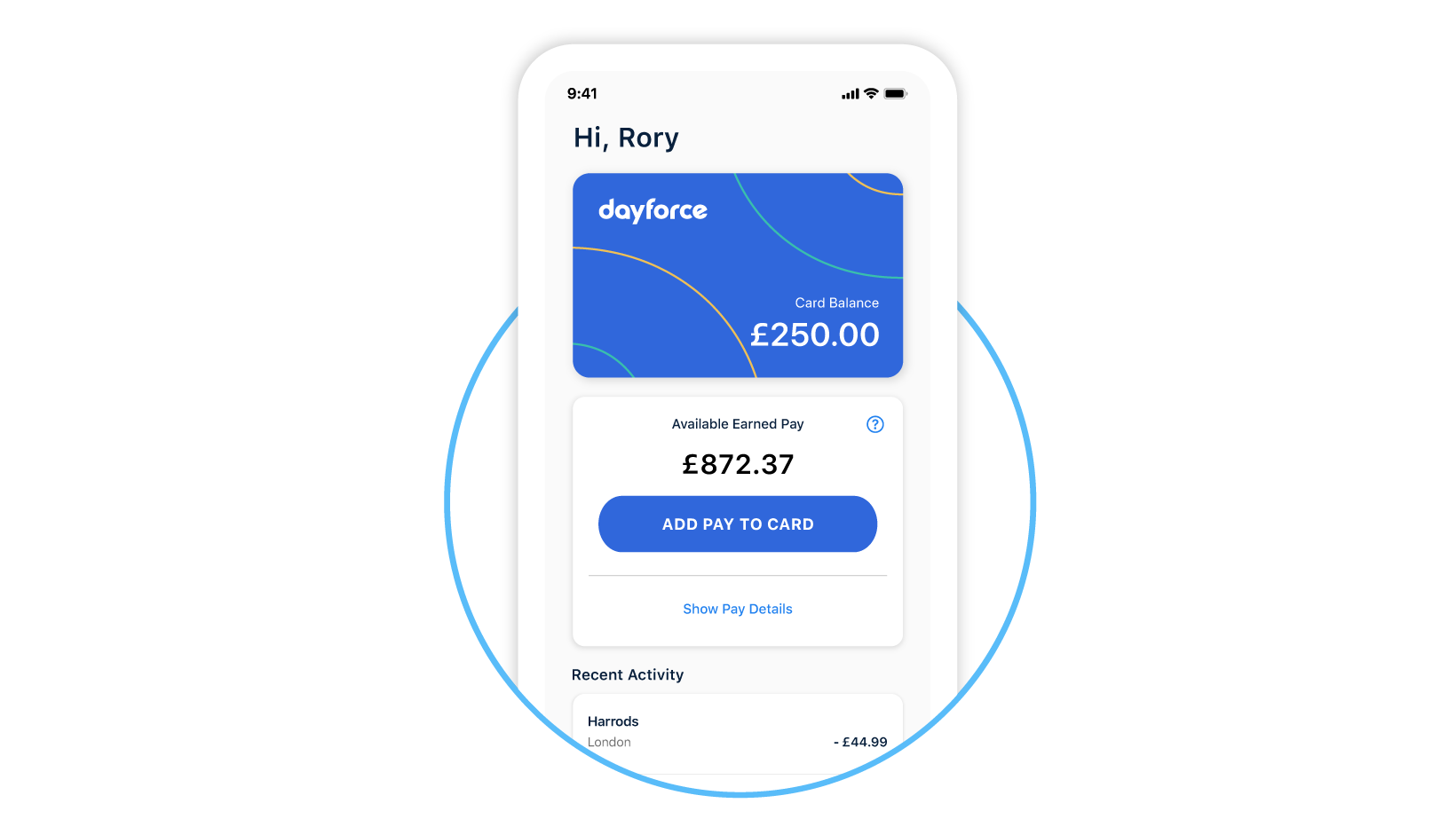

Pay your people directly on their Dayforce Prepaid Mastercard® without any hidden fees.

Empower employees to easily manage their expenses with the Dayforce Wallet mobile app.

Attract and retain new talent

Attract talent by offering on-demand pay as an enticing benefit.

Reduce 90-day attrition by as much as 25% among hourly employees.*

Minimise time-to-fill open positions by 13%.*

Source: Dayforce research, Jan.-June 2021

The modern way to pay

Deliver on-demand pay, regular payroll deposits, and off-cycle payments, all in one solution. Dayforce Wallet is an extension of Dayforce Payroll, making it easy to pay on demand.

What's Included

Make any day payday

Traditional pay cycles are a thing of the past. Dayforce Wallet gives your people the financial control they need to stay motivated and productive at work.

Trusted by over 6,000+ Businesses

Why our customers love Dayforce

“Today, innovation comes in the form of things like Dayforce Wallet. The idea that you have to wait for your paycheck to spend it is something Dayforce challenged, and they continue to innovate – that's the biggest reason we're partnering with Dayforce.”

Vinny Johar

Global Head of Reward Operations

I think Dayforce Wallet is impacting how people get paid, and it’s going to influence the way that people work in the future. Why do you have to wait to get paid for the work you do? I think it’s a great benefit when it comes to retention and attracting associates.”

Steve Mauricio

Director of HRIS, Caleres

“What I love about Dayforce is the fact that my employees love Dayforce. My employees love the ease of access. My employees love Dayforce Wallet. It's about making the employee experience better, making our employees happier, making us a better place to work and to perform.”

Tom Walker

CFO

Ready to get started?

FAQ