The complete guide to payroll outsourcing

When do the benefits of managed services outweigh doing it yourself? Outsourcing can help reduce risk across your operations and allow you to take advantage of technology and expertise not available in-house.

Table of Contents

As organisations grow and scale, many processes get more complex and it’s easy to get distracted from the core business that drives your bottom line. For processes that are data-heavy, time-consuming, and manual, such as payroll, you may find it more advantageous to delegate this work to a specialized partner instead of taking it on in-house.

Many companies today are looking for ways to stay focused on their strategic objectives and limit their involvement in time-consuming processes. Payroll outsourcing services are one such solution, as organisations can focus on work that moves business forward, reduce risk, and increase the accuracy and efficiency of their payroll processes.

The following guide will help you determine if outsourcing payroll is right for your employees and your organisation.

Chapter 1: Reduce risk across your organisation

Reducing compliance risk is a key priority for leaders around the world. Deloitte’s Global Payroll Benchmarking Survey cited compliance as the top area for improvement in payroll processes. Non-compliance can result in costly fines, dissatisfied employees, and damage to your company’s reputation.

While your company needs to stay on top of compliance requirements, however, keeping up with changing regulations can be both time-consuming and challenging for your team. Payroll administration requires specialized knowledge of applicable laws to ensure your people are paid accurately according to local rules.

For your organisation to grow, particularly as you expand across new operating regions, having systems that can scale with you are vital to your success. Core back-office functions such as payroll is critical to running your business and ensuring your people are compensated appropriately, no matter where they’re located.

Lowering the manual work of compliance

Often, organisations will rely on rigorously controlled processes to reduce the likelihood of errors and resulting fines. Achieving these standardized processes for managing risk might be feasible for smaller teams, but maintaining consistency can become even more cumbersome as your workforce expands across borders. Your organisation may not be sufficiently staffed to process payroll, especially in multiple regions with different tax rules and obligations.

Compliance challenges are a top pain point for payroll professionals today, cited by 42% of respondents. – Future of Payroll Survey

Instead of allocating staff in-house to keep up with ever-changing compliance requirements, you can reduce risk to your organisation by allowing payroll professionals to help you manage the complexities associated with compliance. A single partner can monitor product-impacting changes for you and help reduce your exposure to costly payroll and tax filings. This is one of the top benefits of outsourcing payroll activities.

Related content:

Navigating payroll complexity

If organisations can’t pay their people accurately, on time, and in accordance with various legislative requirements, they put themselves at risk in several ways. Read more about reducing your organisation’s risk exposure.

Mitigating risk in foreign waters

The stranded Ever Given ship in the Suez Canal was a clear example of multiple systems without a centralised governance model. The incident left a wake of chaos, a $1 billion claim in total damages, and impacted supply chains around the world. Read more about mitigating both fiscal and operational risk with standardised practices.

Chapter 2: Focus on your core business

Build it yourself or hand it off to someone else. Consider how critical the function you’re outsourcing is to your business. How you perform a core business function like payroll may not be a competitive differentiator, but it still provides immense value in the form of paying your people accurately, fairly, and on time. When you can identify areas of your business to outsource, you can free up time and resources to refocus on what gives you a competitive edge.

Imagine Michael, a CFO of a large enterprise in the energy and materials industry. The mining sector is rapidly growing since they are important contributors to economic growth and the raw materials they produce. As Michael’s company rapidly expands into new regions, he needs to scale his pay administration accordingly.

One of Michael’s largest challenges is maintaining costs at budget. He’s responsible for the overall health of the organisation and is concerned his team may have not have enough people to process payroll as the organisation is growing quickly. He also knows his sector is facing an aging workforce and shortage of skilled talent. He could choose to redeploy some HR personnel to focus on talent retention and development to meet the sector’s future demands.

Many companies choose to outsource functions that aren’t as critical to their business and don’t offer a competitive advantage.

Cost of resources and head count

Running payroll can be complex. It requires significant investment in staff, systems, and procedures. In addition to the administrative burden on your team, it demands a lot of resources in the form of both time and money.

Businesses need to staff payroll administrators with highly specialised skillsets who have the right certifications, knowledge, payroll software experience, and data analysis skills to support your finance department’s goals. In addition to hiring the right people and using the right systems, ensuring that their credentials and technical skills are kept up-to-date can mean additional administrative work and ongoing course fees.

Consider whether it’s worth devoting the financial resources that are required to keep your payroll professionals up to date with compliance requirements and training. Keep in mind that this cost may also include new head count, as you will need to hire and train new payroll professionals to support any new operating regions your business expands into.

Related content:

Leveraging systems built for change

Riding the waves of disruption isn’t always predictable. Structuring your business processes with agility in mind can help you prepare for change. Read more about navigating change with outsourcing.

Chapter 3: Generate actionable data insights

Organisations know how powerful data is, but it’s not always easy to action. When you start exploring smarter data management options, you can gain more valuable insights from your pay data and employee cost more quickly and accessibly. Organisations need key metrics such as cash flow, revenue forecasts, budget, and labour costs to be accessible and available as quickly as possible.

Better data reporting starts with managing source data that you can trust is accurate. Poor data quality can make achieving and demonstrating compliance incredibly challenging for employers. EY’s Global Payroll Survey reported that about 32% of organisations consider inaccurate employee source data being imported into the payroll system to be the topmost compliance challenge in their payroll in 2021.

69% of respondents reported having issues with their payroll data. – Future of Payroll Survey: Mapping the journey ahead for payroll professionals

Leveraging the power of pay analytics

To transform your payroll function into a strategic opportunity, you need to be able to leverage your data for smarter decision-making. The right partner can feed you smarter data insights and transparency into your payroll.

Why does real-time data matter? You can be more responsive instead of looking back and struggling to catch up. With more accurate and timely reporting, you can gain more valuable insights into your pay data—including data that feeds into other HR strategies, such as pay equity across your workforce. Only half (55%) of leaders surveyed in Ceridian’s 2022 Executive Survey say they are currently using technology to benchmark compensation. With a global view of workforce spend, leaders can better understand and leverage their won data, giving them an edge when it comes to decision-making and planning for your HR and financial strategies and budget planning.

Related content:

Is outsourcing right for your organisation?

There are many benefits of managed services, but it isn’t always easy to know when outsourcing makes sense for your business. Read more in our checklist for when managed payroll is a good fit for you.

Chapter 4: Scale across new operating regions

Adopting a global mindset sets your organisation up to succeed. Companies with the right growth-oriented operating models and capabilities deliver three times more total shareholder return than their peers, according to McKinsey’s growth blueprint.

How does having a global mindset help shape your operating practices? Ask yourself this: How well do you know the tax and employment laws in China? This is an example of payroll-impacting legislation that your payroll team would need to be familiar with if you hire personnel or expand operations in Asia-Pacific regions.

Rapid growth or restructuring can cause your organisation to expand unpredictably, placing new pressures on your HR and payroll teams. Payroll practitioners are usually certified at a regional level and may feel unequipped to handle new legislative environments.

Adding head count for a global team of payroll personnel isn’t realistic for every organisation. When your multi-country operations are centralised with one vendor, you can simplify everything from support tickets to service-level agreements. International payroll outsourcing can be a good option for you if you’re looking for one partner to coordinate payroll processing on your organisation’s behalf.

Sourcing regional payroll personnel

Small to medium-sized businesses may be able to have a single specialist process all their payroll, but this system can fall apart if your staff member leaves or is absent during the payroll cycle. As your business grows, your payroll function needs to be able to scale with your workforce and operations.

While adding head count may seem like the right solution, it can be costly and difficult to hire in new regions. Plus, your payroll professionals may struggle to keep up with new legislation as your organisation adds head count or acquires companies in new regions. Having operations in new regions may mean you’ll need to account for different currencies, time zones, and regional tax legislation.

To ensure international payments run smoothly, it can be simpler to have one centralised process across your operating regions. Look for a provider equipped with the technology to scale and adapt as your business needs change.

One contract, one support team

To foster innovation and agility, your borderless workforce needs a foundation that allows all back-office functions to operate efficiently wherever your business grows. Some of the hidden costs of your payroll administration processes can come from system maintenance. Your hardware and software systems both need to be maintained and updated to ensure your data is secure.

Instead of coordinating with multiple payroll providers, you can leverage your own specialised network under one centralised contract and one support team to coordinate payroll administration on your behalf. Growth becomes a natural part of your organisation when your managed services best practices help simplify your operations and reporting at scale.

Related content:

The power of a single solution for payroll

Hiring a borderless workforce comes with many advantages, but handling global payroll introduces new complexity that your team may not be equipped to handle. Learn more about the benefits of a single solution for paying your global workforce.

Chapter 5: Improve efficiency

Outsourcing to a partner with the right technology can help improve your operational efficiency in every step of the payroll process.

When organisations deal with frequent payroll issues, such as pay errors, support resolve times, and audit times, this can be frustrating for both your HR team and your workforce. Maintaining the status quo and not offering employees the advantages available with newer technology can also reduce employee satisfaction.

Organisations spend a significant amount of time processing, auditing, and reconciling pay, including tracking payroll error rate as a Key Performance Indicator (KPI). The Global Payroll Management Institute’s 2022 Getting the World Paid survey found the most prominent causes for decreased payroll accuracy were HR data input errors, lack of HR processes, and retroactive corrections.

Outsourcing could be a good option for your organisation if you’re also spending a lot of resources correcting pay errors or reconciling pay data across multiple data sources. Try looking for a partner that can handle routine, transaction-oriented processes and high volumes of data.

Many businesses need specialised applications to pay people accurately and on time. The right payroll outsourcing partner can process and monitor payroll proactively for material variances. Instead of building a solution in-house, you can partner with professionals who specialise in payroll administration.

Opting out of inefficient and time-consuming processes

Another powerful benefit of outsourcing payroll is you can give your people back time for higher-value work. Instead of spending hours manually processing payroll, they can devote time and resources to more strategic work, especially for those in roles where payroll is not their specialty.

EMEA, APAC, and LATAM respondents of Deloitte’s Global Payroll Benchmarking Survey said they had more than 40% of their effort tied to manual data loads. This is not unusual because these regions typically have a higher volume of payroll vendors that come with a lack of consolidation and standardisation.

You can increase the accuracy and efficiency of your payroll processes and retain insight into your data by partnering with the right payroll professionals.

Related content:

How to simplify payroll

Payroll is one of the most vital administrative activities but, for many companies, the process is riddled with inefficiencies and errors. Read more about saving time and simplifying payroll.

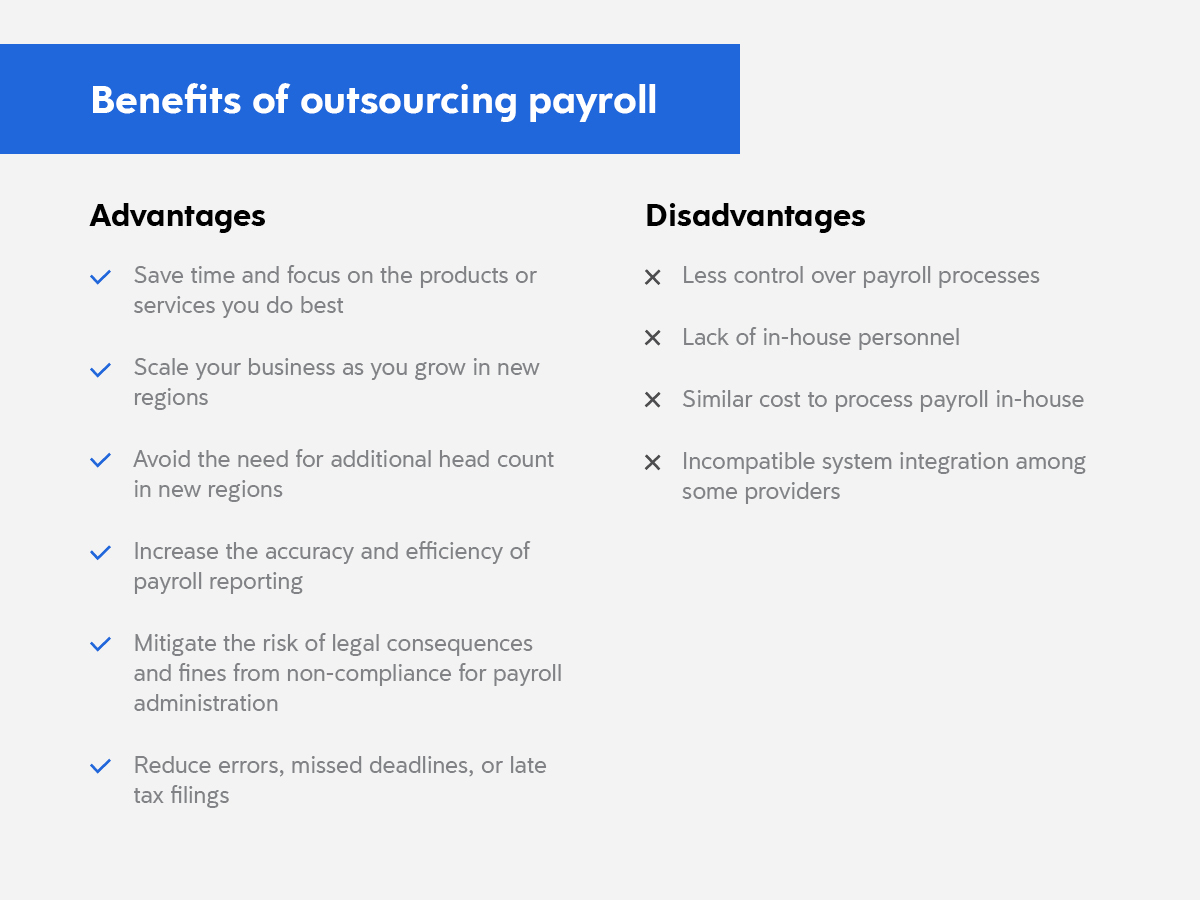

Infographic: Benefits of outsourcing payroll

You may want to weigh the pros and cons when you’re exploring managed options. The right solution may look different for every organisation’s objectives. Whether you’re responsible for managing your organisation’s payroll or looking into outsourcing payroll, see our advantages and disadvantages chart below for a quick overview.

You may also like:

Ready to get started?